- Brazil | 12 March 2016

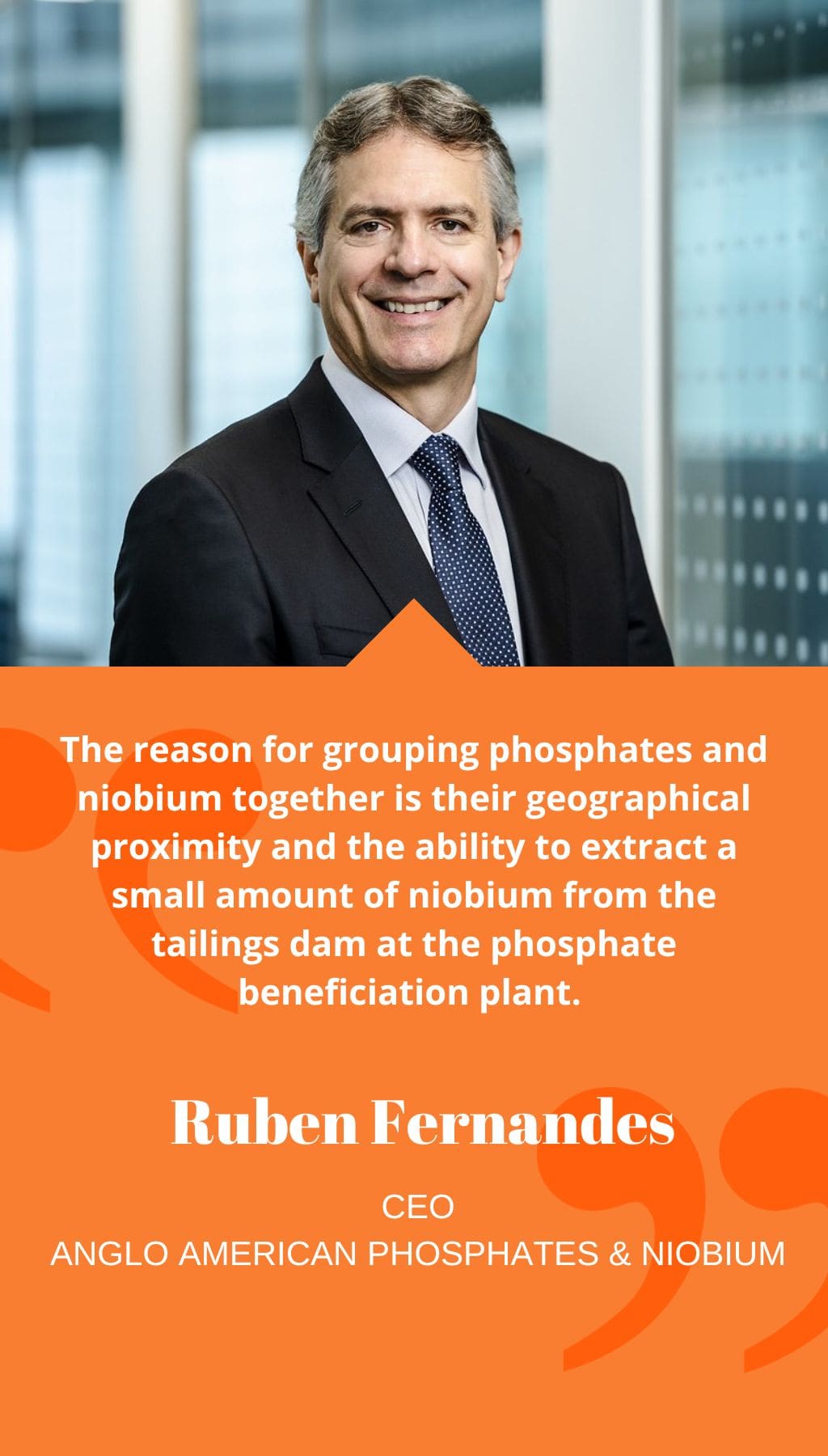

Can you explain the reasons for grouping phosphates and niobium together, and provide an update on the performance of this unit in 2015?

The reason for grouping phosphates and niobium together is their geographical proximity and the ability to extract a small amount of niobium from the tailings dam at the phosphate beneficiation plant. Even though the markets for these two minerals are different, they fit well from a business perspective, as they are less volatile than base or precious metals. Phosphates are linked to fertilizers, which are a guaranteed growth market, and niobium is still a niche material whose buyers are mostly concentrated in Brazil and Canada. In 2015, the unit performed well and managed to stick to its budget despite adverse economic conditions in Brazil.

Can you provide some details about your phosphate mine and processing facilities in Brazil?

Anglo American has one phosphate mine in Ouvidor, Goiás, which has been in operation for 20 years and has a projected lifespan of another 40 years. The mine has one of the highest grades in Brazil, with an average of 11% to 12% P2O5. Two separate fertilizer production plants receive the mine’s output. The first plant is in Catalão, which is connected to the mine by mineral pipeline, and the second plant is in São Paulo state, which receives most of its raw material by railway and truck. The dual production strategy is designed to supply the two principal agricultural regions of Brazil, with the plant in Goiás located on the frontier of the new agricultural powerhouses of the MaToPiBa states. All fertilizer is sold to blenders who mix a variety of NPK products and sell them on to distributors and agricultural producers.

Given that fertilizer minerals are a strategic market at the moment, are you looking to acquire any new projects or branch out into potash as well?

At present, the focus is on expanding the existing phosphates mine. The enlargement is at the pre-feasibility stage and must be based on a solid foundation and follow the international protocol set down by Anglo American. The company hopes to see the study completed by the end of 2016, the final feasibility study finished by 2015, and to submit it to the board for final approval by 2016. The eventual aim is to double total production from 1.4mty to 2.8mty, although the company is still working on the details of how exactly this will be accomplished and what the final product will be. Anglo American is not interested in acquiring new projects at present but is more focused on developing brownfield projects that have already demonstrated proven value.

Last year saw a 56% rise in profits for Anglo’s niobium business. Can you provide us with an overview of the current niobium facilities in the country, and shed some light on how you accomplished such a dramatic rise?

Anglo American has two facilities for niobium extraction in Brazil: the main one is the open-pit Boa Vista mine, which is located in Goiás, and the second is the tailings dam at the beneficiation plant for the phosphates operation. The output from both of these sources is then integrated at the processing plant in Ouvidor to produce ferroniobium. The company is expanding Boa Vista both in terms of the mine itself and the capacity of the beneficiation plant. Currently, only oxide ore is processed, but with the new expansion, fresh rock can also be upgraded, which will increase total production by about 50%. The 56% rise in profits last year was primarily achieved through cutting costs, improving efficiency, and increasing productivity, particularly in the area of upgrading recovery techniques.