- Trinidad & Tobago | 8 July 2013

The results of the latest deepwater bid round are being announced this week. This round saw considerably more success than past ones; in this context, could you elaborate on the changes in the structure of these bidding rounds compared to previous rounds?

We made several changes to the fiscal regime for this bidding round. Firstly, we increased the rate of cost recovery to 80%, whereas the recovery rate was 60% in prior rounds. Secondly, we repurposed all the 3D seismic data that we held for deep water. Thirdly, we marketed the bidding rounds differently by attending many international conferences. We also presented fewer blocks, only six, compared to eleven deepwater blocks in previous rounds. Another factor was the opening up of the Guyana basin, which contributed to greater prospects for Trinidad. Finally, many companies have realized Trinidad is a good place to do business because of our stable political situation and English language proficiency. Companies such as BP have had a good experience in Trinidad over the last 50 years.

What levels of interest are you expecting to see from foreign companies in next year’s bidding rounds?

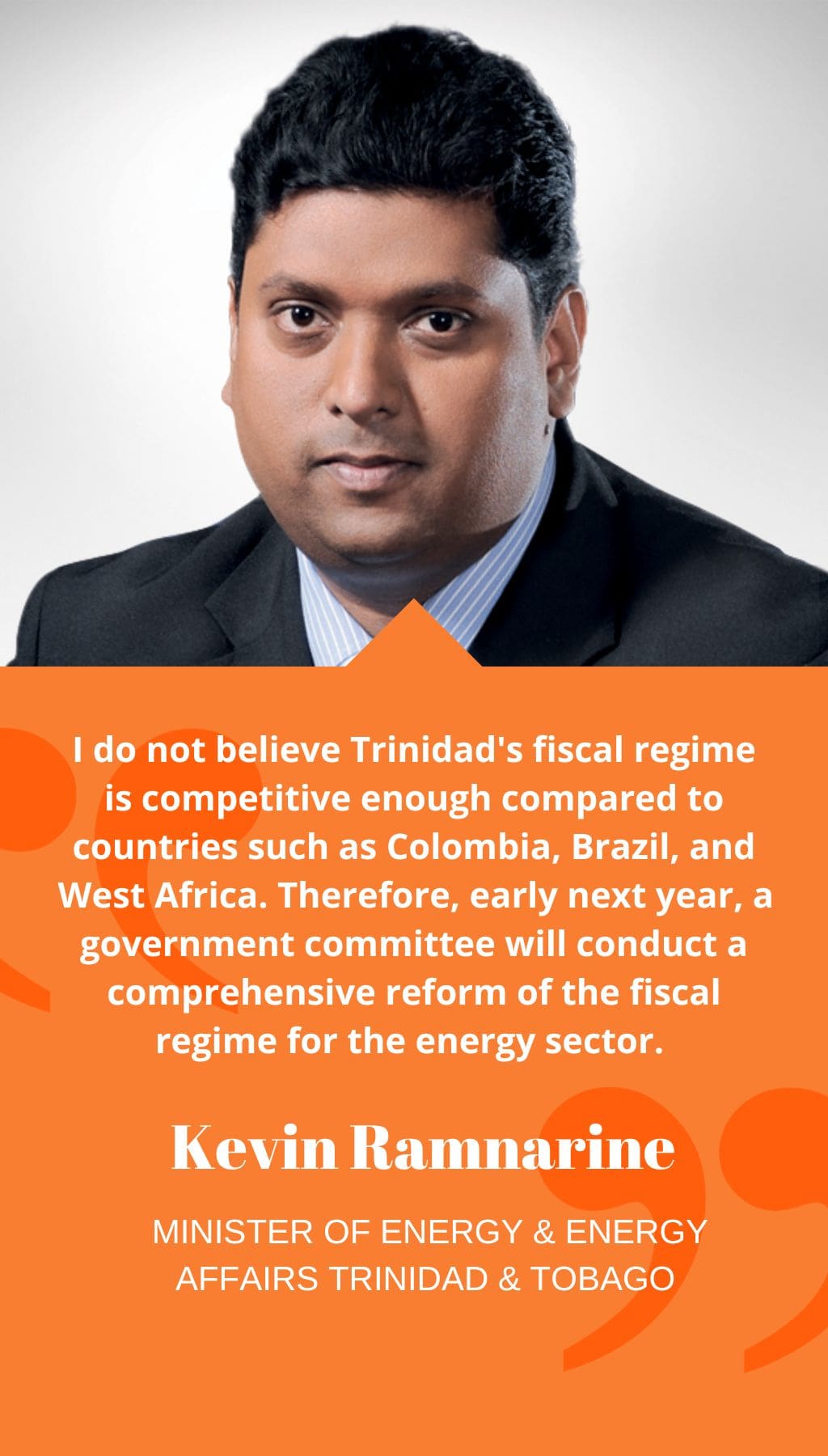

I do not believe Trinidad’s fiscal regime is competitive enough compared to countries such as Colombia, Brazil, and West Africa. Therefore, early next year, a government committee will conduct a comprehensive reform of the fiscal regime for the energy sector. There will also be a land-based bid round launched in January spearheaded by Petrotrin and supported by the Ministry of Energy. We went on a road show in Calgary to promote this bid round because we believe smaller companies are the best fit for land in Trinidad. In March 2023, we want to launch another deepwater round with six new blocks, and three companies have already shown interest. Deepwater is still in the exploration phase. Exploration took place on our continental slope in 2002, which proved the existence of a working hydrocarbons system but did not find commercial quantities of oil and natural gas. However, things will have changed a lot since 2002, and technology has taken new leaps. With a new fiscal regime, new technology, and greater processing, we believe Trinidad’s deep water holds great potential.

Regarding the overhaul of the fiscal regime, what needs to change in order to make Trinidad more competitive?

The fiscal regime cannot be considered solely as a mechanism to collect money. It must meet the objectives of the country, such as fashioning the fiscal regime around CSR or local content. Many global reports have ranked Trinidad in the top quartile in terms of highest government take in the world. I would like Trinidad to be competitive but still have a fair return to the state. Moving forward, we will reexamine taxation, production sharing agreements, and other factors to see how we can best reach that balance. Production sharing contracts have evolved significantly in Trinidad; in the 1970s, the government take was based on the level of production, and in the 1990s, we introduced a matrix based on production level and price. Today, we also need to consider costs. Costs in the industry began to increase dramatically around 2005, concurrently with the demand for steel in China. Costs are a major factor in the competitiveness of the environment. The costs to produce natural gas are the same as the costs to produce a barrel of oil, but gas is much less valuable. Trinidad has become predominantly a gas-based economy.

Let’s talk about the NGC model. How do you think the structure might change to ensure a fair amount of risk and supply guarantee?

The NGC model has been successful since its establishment in 1975. It has made the NGC the most valuable company in the Caribbean with assets close to 6 billion USD, healthy profits and constant dividends. However, I have questioned its relevance moving forward as it was premised on a world in which the U.S. was in decline with regard to gas. We are currently re-evaluating the NGC’s role as the sole monopoly on natural gas. We have already started to see deviations from this model, such as the implementation of hybrid contracts, where customers have a direct relationship with the upstream supplier. In 2013, a major policy question is how the NGC can mitigate the increasing cost of buying natural gas while still satisfying the demand for lower prices from companies on the Estate.

What models have you considered for the NGC’s future role?

The NGC will continue to function as a pipeline operator, buyer, and seller of natural gas due to the long-term nature of contracts. However, a new dimension would be for the NGC to expand globally. Our current model no longer guarantees growth, so we are considering acquisitions within and outside of Trinidad, including in West Africa. We have also started marketing our own LNG and are exploring the possibility of marketing Petrotrin’s cargoes. It is possible that we may see the emergence of an LNG marketing company jointly owned by Petrotrin and the NGC.

What would be the impact of smaller local infrastructure projects, such as the Eastern Caribbean pipeline and CNG projects, on Trinidad?

The Eastern Caribbean pipeline and smaller CNG projects are relatively small-scale. For example, the gas fill project would not require more than 70 million standard cubic feet of gas. However, the LNG market is changing, with an emerging market for smaller countries that require smaller ships and trains. Small countries are constrained by both market and geographical factors. The CNG project plan for Trinidad and Tobago is centered on Centrica’s development of block 22. The CNG facilities will supply CNG to consumers in the Caribbean, with a significant amount of gas likely to go to Puerto Rico. The Caribbean islands have been paying attention to balance of payments regarding the cost of purchasing oil for power generation and transportation, and there is a desire to convert to natural gas-fired power. This has already occurred in the Dominican Republic and Puerto Rico but not yet in the rest of the English-speaking Caribbean. Trinidad is the only supply in close proximity to many Caribbean countries as Venezuela has not yet developed a gas export industry.

Can Trinidad learn any lessons from Colombia’s democratization of its oil industry?

Colombia has made its oil industry available to smaller operators, who are nimble and have smaller overheads. Trinidad can observe this aspect and apply it to its own industry. Another aspect is the refining industry. In the past two years, two refineries have closed in the region, including the Valero Aruba Refinery and the Hovensa refinery in the U.S. Virgin Islands. This leaves us with the Petrotrin refinery and refineries in Venezuela, which have maintenance and accident issues. No new refining capacity is coming onstream anywhere in the Americas, except for Brazil. In the next 5-10 years, there will be a bottleneck regarding refining capacity in this region, and this is where Trinidad can play an essential role due to its strategic location. The National Energy Corporation (NEC) will be expressing interest for a new refinery in Trinidad.