- Peru | 20 September 2021

How can the State prevent conflicts like the one that has arisen in Las Bambas?

The role of the State should be more preventative than reactive. On one hand, there should be a greater sense of urgency in enforcing the rule of law, while at the same time fostering social peace through greater effective presence of the State in mining areas. Furthermore, the State must improve its ability to execute the funds generated by the industry. At the national level, the mining-energy sector has generated S/ 67,000 million in canon and royalties over the past 10 years, but the execution level in the regions averages only 66%. Without greater execution capacity, there will continue to be deficiencies in basic services and infrastructure, the roles of the State and the private sector will continue to be confused, and communities will continue to direct their demands towards companies.

How does delays in promised investments by authorities affect the trust of communities?

Trust must be generated, and unsatisfied demands or valid expectations must be separated from acts that we have seen on the part of certain individuals who incite communities to act outside the law. For trust to be achieved, the State must also promptly fulfill its commitments. For example, in the case of the oil pipeline, where operations were halted for 90 days, there were issues of non-compliance on the part of the State; in the case of Las Bambas, the State has also been delaying the fulfillment of certain agreements, such as those related to the national highway. When it reaches the point of using force, there is no longer a dialogue, because the company and the authorities are under coercion.

Will we see more world-class discoveries in Peru?

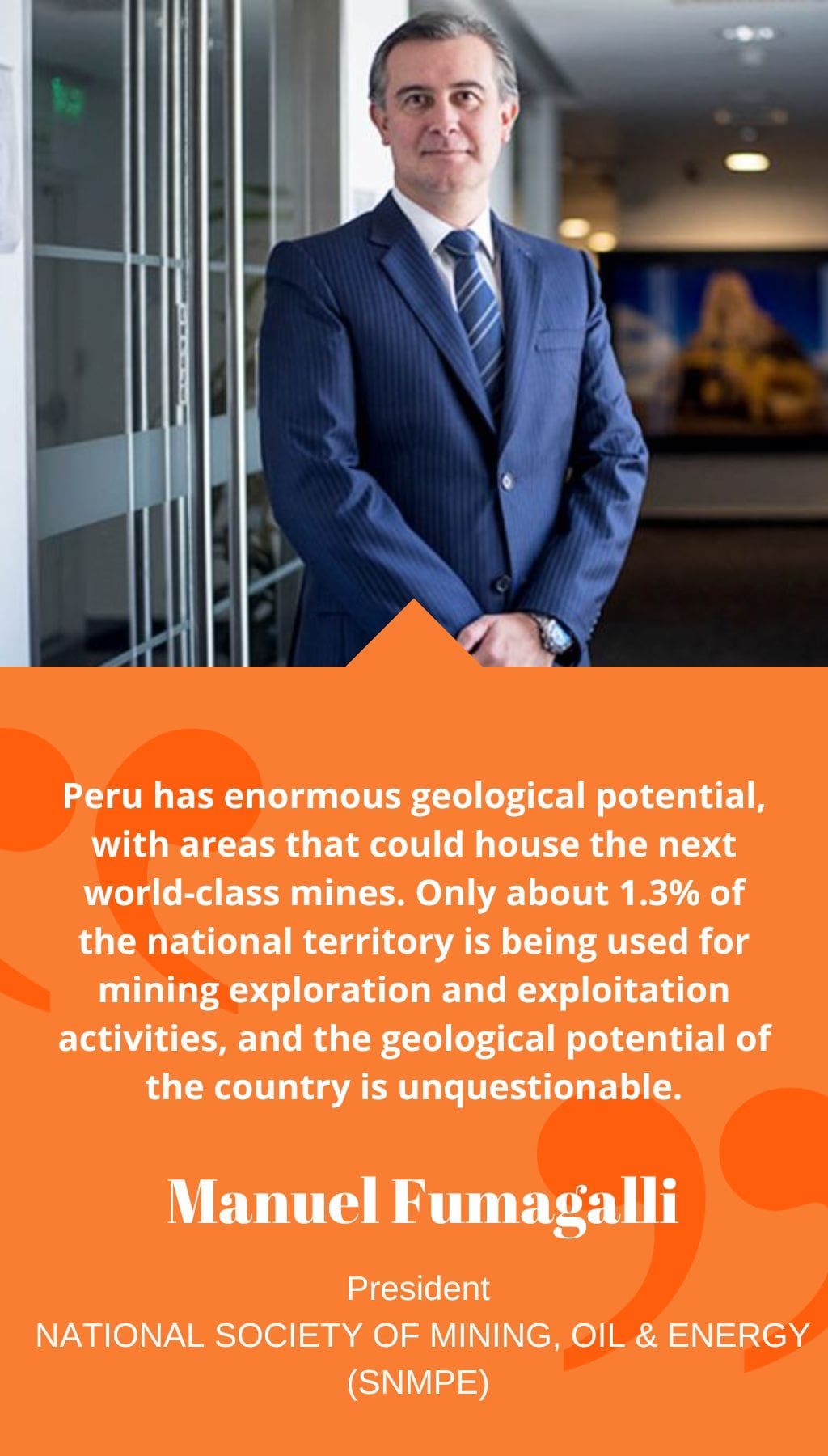

Peru has enormous geological potential, with areas that could house the next world-class mines. Only about 1.3% of the national territory is being used for mining exploration and exploitation activities, and the geological potential of the country is unquestionable. Peru has 10% of the world’s copper reserves, 5% of gold reserves, and 20% of silver reserves. In Latin America, in the Fraser Institute survey, we are above Chile in geological potential, but in regulatory terms we are below our main competitors. This obliges us to continue working on opportunities for simplification of regulations, as well as effective mechanisms that reinforce institutionalism and dialogue.

What is your prediction regarding the price of gold and copper?

The fundamentals of gold are solid in the short and medium term. There is geopolitical instability with issues such as Brexit, tensions between the United States and Iran, and the trade war between China and the United States. The world is not more stable today than it was a few years ago, and that generates fear; in that sense, gold positions itself as a safe haven investment asset. With regard to copper, we see a drop in its price due to uncertainty in the markets caused by the trade war, but once this is overcome, we should see an improvement in its price driven by greater demand for the metal for electrification, renewable energies, electric cars, and electronic products.

What positive impact can projects like Quellaveco have, and what other projects in the country’s portfolio do you expect to be built soon?

Large-scale construction projects such as Quellaveco, Mina Justa, and the expansion of Toromocho have significant positive effects on the national economy due to the levels of investment they represent; they also provide formal employment for thousands of Peruvians and stimulate local economies where they are developed. Their contribution has been reflected in the 37% increase in mining investment in the first quarter of 2020 compared to the same period last year.